Billions in housing levy funds remain idle amid slow project rollout

The Parliamentary Budget Office reveals that while the government aimed to deliver 200,000 housing units annually, it has achieved only 1.2 per cent of its target in two years.

The Parliamentary Budget Office (PBO) has warned that inefficiencies in the Affordable Housing Programme (AHP) rollout have left billions in housing levy funds idle, while private developers retreat from new projects, straining Kenya’s construction industry.

The PBO reveals that while the government aimed to deliver 200,000 housing units annually, it has achieved only 1.2 per cent of its target in two years.

More To Read

- Relief for civil servants as SRC moves to address heavy salary deductions

- President William Ruto unveils Sh44 billion Linzi listing, eyes IPOs for State firms

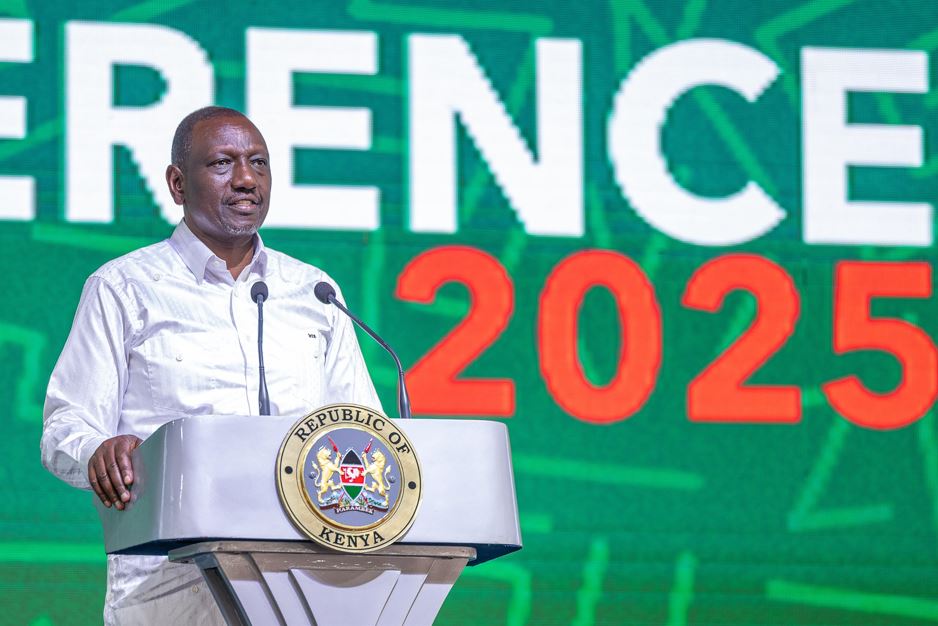

- Ruto defends economic reforms, vows to push ahead with affordable housing, cost of living agenda

- Kenyan diaspora births surge 15 per cent to 5,694 amid population growth

- Government invests Sh90 billion in affordable housing projects backed by Sh120 billion levy collection

- State stops market projects funded by housing levy, agrees to refund money after COTU talks

According to the Office, many private developers have halted projects to make way for the government’s initiative, yet the slow pace of implementation has stalled the sector’s growth.

“The anticipated active role of public investment in the construction industry may have impacted the private investments in the sector, thereby reducing the overall contribution of the sector to the GDP as well as a reduction in credit to the private sector for the building and construction sector,” reads the report.

The Kenya National Bureau of Statistics (KNBS), in its third-quarter GDP report for 2024, identified the construction sector as one of the key industries that dragged down Kenya’s economic growth, which fell from six per cent to four per cent. The sector contracted by two per cent in the quarter leading to September 2024, with key indicators such as cement consumption and galvanised sheet production declining.

“Cement consumption declined by 10 per cent to stand at 2,196.7 thousand tonnes in the third quarter of 2024, from 2,439.7 thousand tonnes consumed in a similar quarter of 2023. Similarly, the production of galvanised sheets declined by 4.2 per cent to stand at 68,719.5 metric tonnes in the quarter under review,” KNBS said.

Credit decline

The report also highlights a drop in credit extended to construction sector enterprises, from Sh149.6 billion in the third quarter of 2023 to Sh129.2 billion in the same period last year. The PBO attributes this decline to private developers' hesitation to invest in new projects amid uncertainties in the housing market and fears of default, leading banks to scale back lending.

“The decision by private sector developers to hold back on new projects stems from concerns over market viability for their properties, as the government’s AHP dominates the sector,” the PBO noted.

Despite private developers slowing down on new constructions, the government is grappling with idle funds, with a significant portion of the housing levy remaining unused.

The PBO report, which assesses government plans under the 2025 Budget Policy Statement (BPS), highlights that these funds are either lying idle in the Affordable Housing Fund or invested in government securities, further exposing inefficiencies in the programme’s implementation.

“These resources are either idle in the fund or invested in government securities. This is an indication of systemic inefficiencies in the implementation of the programme,” reads the report.

With the construction sector playing a crucial role in Kenya’s economic growth, experts warn that prolonged delays and inefficiencies in the AHP could further weaken the industry and slow down overall economic recovery.

The government is now under pressure to accelerate the rollout of affordable housing units to ensure the funds collected through the housing levy are put to use effectively and to restore confidence among private developers.

Top Stories Today

- 10 Kenyans died in police custody in last five months, Murkomen tells MPs

- South Sudan refutes reports on Palestinian resettlement talks with Israel

- Murkomen: Budget shortfall stalls Kenya’s police body camera rollout

- CAF fines Kenya Sh12.8 million over stadium security breaches at CHAN 2024

- DNA links body parts to five women in Kware dumpsite case

- All 14 devolved functions, assets fully transferred to counties - Ruto